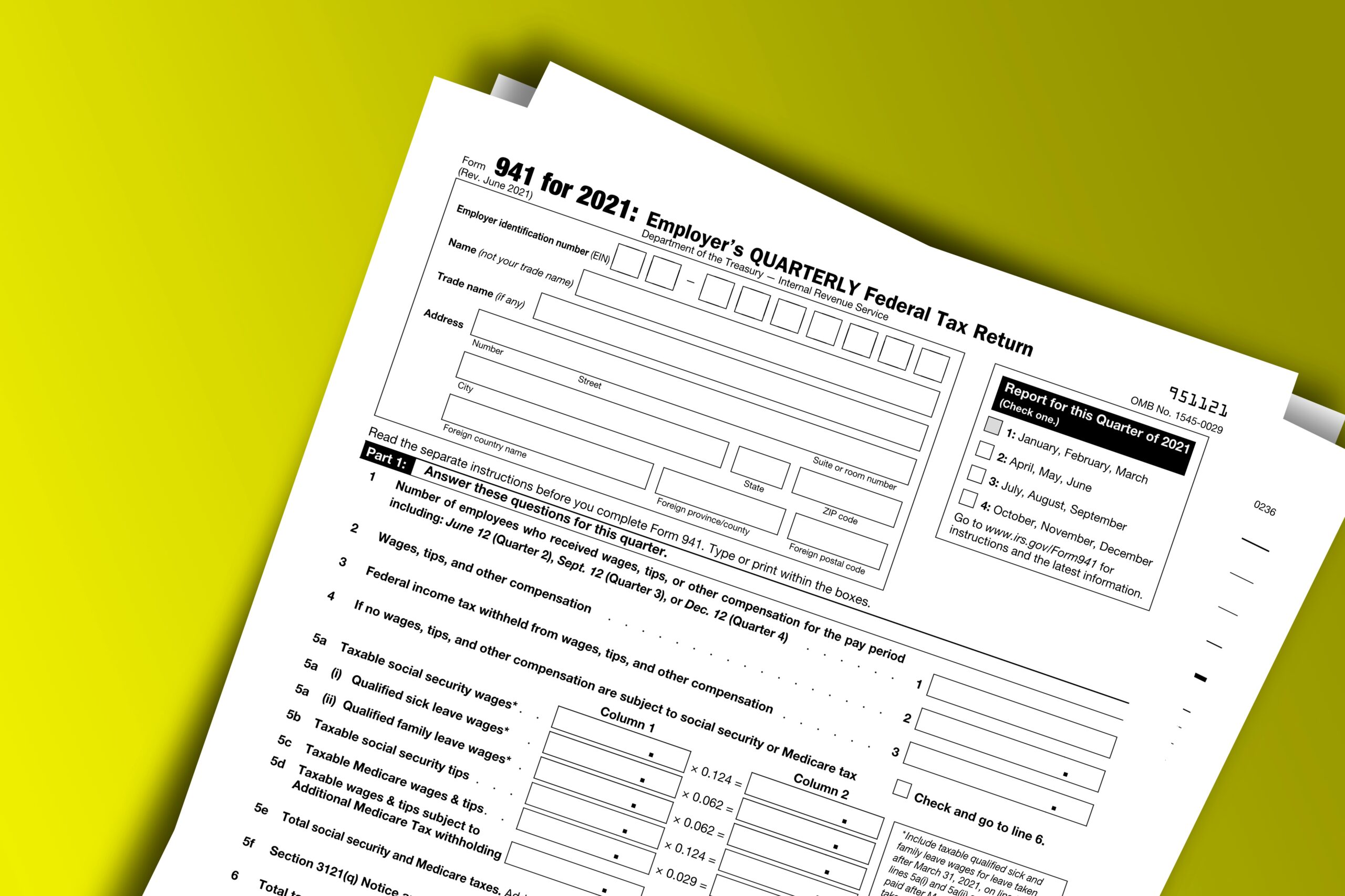

If you’re a business that pays employees, chances are, you’ll be required to file a Form 941 with the IRS each quarter. Form 941, also referred to as the Employer’s Quarterly Federal Tax Return, is a three-page form that is used to report and calculate federal payroll taxes, including federal income tax as well as the employee and employer portions of Social Security and Medicare taxes. Reporting, filing, and making payments for quarterly taxes can seem like a daunting task, and understanding what is required and how to file can save businesses a lot of stress. For those responsible for completing and filing the form, this may be a handy guide or refresher to help when it comes time for the next quarterly filing.

An initial form 941 needs to be filed for the first quarter in which wages are paid that are subject to social security, Medicare, and/or federal income tax withholding, and every quarter after that, until the final return has been file. Seasonal employers may be exempt from filing in certain quarters if no wages are paid. Due dates for the 941 filing generally fall on the last day of the month following the end of each quarter: April 30th, July 31st, October 31st, and January 31st. If any of these dates fall on a weekend or federal holiday, the due date is moved to the next business day. Filings will be considered on time if the post-marked date is on or before the due date.

What do I need to complete the 941?

The first step is to gather the information needed to complete the form. Having the information ready to go will make it easier to complete the form without having to scramble for data at the last minute. The form will require several pieces of information. The person completing the form should have for the quarter:

- Number of employees who were paid

- Total wages paid

- Total wages subject to FICA taxes (Social Security and Medicare)

- Amounts withheld for FICA and federal income taxes

- Federal payroll tax deposits that were made

While this may seem like a lot of information to gather, most payroll systems can easily produce reports that contain the data needed for the 941. If reports are unavailable or the system used for payroll doesn’t support or allow for this type of reporting, the person responsible may need to refer to payment records and bank statements to get the information needed. Many payroll service providers offer quarterly filings as part of their offerings, though it is recommended that businesses still take steps to validate the info to make sure there are no errors or discrepancies on the filing. The preparer should also have the basic information for the business handy, including the employer identification number (EIN) and business address, which is information that will be used to complete the top of Form 941.

Form 941: Part 1

Part 1 of the form will be the most involved part of the form. The information gathered from the payroll system will be used to complete lines 1 through 3, which includes the number of employees paid in the quarter, total wages, tips and other compensation paid in the quarter, and the amount of federal income tax that was withheld. Line 4 should only be marked if none of the wages, tips, and other compensation are subject to Social Security and Medicare tax. This may be the case if the business falls into certain categories. Details regarding religious exemptions and other exempt wages can be found in IRS Publication 15 and Publication 15-A.

Line 5 is split into multiple fields requiring a bit of calculation. Again, information gathered from report(s) available from the payroll system will be helpful in completing these fields. There are also some calculations to be done on the line 5 figures, to determine the appropriate total Social Security and Medicare liabilities. Employers who marked the box on line 4 of form 941 may skip ahead to line 6, which is the sum of the tax amounts reported in lines 3 and 5.

Rounding and individual calculations may result in small variances in the amounts between what was calculated in line 5 and what was actually withheld from employees’ pay during the quarter. These differences should be entered as adjustments in line 7 of the form 941. Line 8 applies to any third-party sick pay where the liability for the employer share of FICA (social security and Medicare) taxes has been transferred from the payer to the employer, unless the third-party payer is the employer’s agent.

Businesses with tipped employees may sometimes run into situations where they are unable to collect the full amount of the employee share of social security and Medicare taxes on the reported tips. Organizations who have employees enrolled in group-term life insurance with benefits exceeding $50,000 should report imputed income based on the coverage levels for each employee. These employers may encounter scenarios in which the employee portion of social security and Medicare taxes on group-term life insurance premiums were unable to be collected, usually for former employees who don’t have any cash wages to offset the employee tax liabilities. Adjustments for tips and group-term life insurance should be entered in line 9. Uncollected employee social security and Medicare taxes may require special reporting on Form W-2.

Line 10 combines the amounts from lines 6 – 9. If the business qualifies for certain non-refundable payroll tax credits, they can be entered as specified in each line of line 11, then totaled and subtracted from line 10 to populate line 12. This figure should not be less than zero.

Deposits made for the quarter, as well as overpayments from prior quarters that are being applied should be entered in line 13. Line 13 is also used to record certain refundable credits such as those for qualified sick and family leave wages and COBRA premium assistance, with the total deposits and refundable credits going on line 13g.

If the amount on line 13g is less than line 12, the difference should be entered on line 14. This is the company’s federal employment tax balance due for the quarter. If line 14 contains an amount less than one dollar, payment is not required. If the amount on line 13g is greater than line 12, skip line 14 and enter the difference in line 15. This is the credit that is due back to the employer for overpayment of federal payroll tax deposits in the quarter. Then, use one of the check boxes to specify whether the refund should be sent back to the employer or applied to the next return (to be recorded on line 13 of the next quarter’s form 941).

Form 941: Part 2

In part 2 of the form, check the appropriate box on line 16 to specify what the tax liability and deposit schedule was for the business during the quarter. Businesses subject to a semi-weekly deposit schedule for the quarter are also required to complete Schedule B of form 941. A business is considered a semi-weekly depositor if more than $50,000 or more in employment taxes were reported in the lookback period, or if the business accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, is used to record the tax liability for each day of the quarter, with totals by month.

Form 941: Part 3

Part 3 (lines 17 through 28) of the form 941 asks for some other general information about the business and some of its activities during the quarter. Form preparers should answer any questions that are applicable to the business for the quarter that is being reported. If the form is being completed for a seasonal employer, or the business has closed or stopped paying wages, the appropriate fields need to be completed here.

Form 941: Part 4

Specify in part 4 whether an employee, tax preparer, or another individual has authorization to speak with the IRS on behalf of the business regarding the filing of the form 941. The designated individual will be allowed to contact the IRS about the processing of the return and provide any missing information and will be able to respond to IRS notices regarding errors on the return. Note that IRS notices will not go directly to the designated third-party, so someone within the organization may need to be responsible for sharing the appropriate information as needed.

Form 941: Part 5

A signature is required in part 5 of the form. The signature should be that of an acceptable person as defined by the IRS, depending on the type of entity that the form is being completed for. Typically, these are the owners of the business or principal officers. If a valid power of attorney has been filed, the authorized agent’s signature will also be accepted. Businesses using a paid preparer such as a CPA or tax professional to complete the form will need the bottom portion of part 5 filled out with the preparer’s information. If payment is being sent along with the filing, form 941-V should be submitted with the payment and the 941. Checks or money orders can be made payable to “United States Treasury.” Payments made via EFT, credit card, or debit card do not require form 941-V.

Want to learn more about Form 941?

Additional details and instructions regarding completion of the form, as well as some helpful links and a PDF version of the 941 can be found on the website of the Internal Revenue Service here. Preparation and filing of the form can be stressful, tedious, and time-consuming, but it doesn’t have to be. Working with a trusted service provider can save the business a lot of headache and stress, and business owners can rest easy knowing the filings will be taken care of, correctly and on time every quarter. The tax and compliance experts at Valor Payroll Solutions can provide your business with the help and guidance to make sure your organization’s payroll tax liabilities are remitted and reported accurately and on time. Contact us and see how we can ease your burden and help you focus on what’s important for your business!